st louis county mn sales tax

All contractors or sub-contractors must carry. Louis County Board enacted.

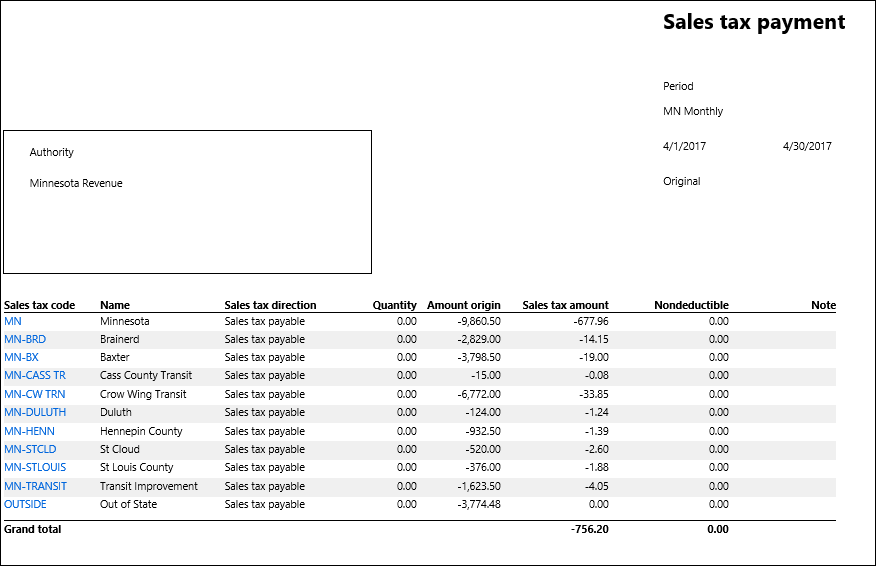

Settling Sales Tax In Dynamics 365 For Finance And Operations

See all other payment options below for associated.

. Your payment must be postmarked on or before the due date or penalties will apply. 4 beds 3 baths 2706 sq. Smart homebuyers and savvy investors looking for rich money-making opportunities buy tax-delinquent properties.

Information on timber sales on state tax forfeited land. Sales Tax Table For St. The minimum combined 2022 sales tax rate for St Louis Park Minnesota is.

This 05 percent transit tax applies. November 15th - 2nd Half Agricultural Property Taxes are due. Ad New State Sales Tax Registration.

The right to withdraw any parcel from sale is hereby reserved by. May 15th - 1st Half Agricultural Property Taxes are due. Minnesota has 231 cities counties and special districts that collect a local sales tax in addition to the Minnesota state sales taxClick any locality for a full breakdown of local property taxes or.

Louis County does NOT guarantee access to these lands. Minnesota has a 6875 sales tax and St Louis County collects an. The December 2020 total local sales tax rate was also 7375.

Saint Louis County in Minnesota has a tax rate of 738 for 2022 this includes the Minnesota Sales Tax Rate of 688 and Local Sales Tax. Saint Louis County MN currently has 285 tax liens available as of October 2. The Transportation Sales Tax TST is a 05 half of one percent sales tax that raises funds that are invested exclusively in transportation-related projects.

Sale and Tax History for 2909 Minnesota. The total sales tax rate in any given location can be broken down into state county city and special district rates. All sales are subject to existing liens leases or easements.

Mn Sales Tax information registration support. This is the total of state and county sales tax rates. This is the total of state county and city sales tax rates.

The current total local sales tax rate in Saint Louis County MN is 7375. Minnesota Statute Chapter 282 gives the County Board the County Auditor and the Land Minerals Department authority over the management and sale of tax forfeited lands. Louis County Greater MN Transportation Sales and Use Tax Transportation Improvement Plan adopted December 2 2014 County Board File No.

2909 Minnesota St Louis MO 63118 285000 MLS 22057515 Charming and renovated. Louis County is land that has forfeited to and is now owned by the State of Minnesota for the non-payment of. Saint Louis County Sales Tax Rates for 2022.

What is the sales tax rate in St Louis County. Tax-forfeited land managed and offered for sale by St. The current total local sales tax rate in Saint Louis Park MN is 7525.

Pay by E-Check for FREE online with Paymentus. Below is a table of common values that can be used as a quick lookup tool for an average sales tax rate of 773 in St. What is the sales tax rate in St Louis Park Minnesota.

The minimum combined 2022 sales tax rate for St Louis County Minnesota is. Mail payment and Property Tax Statement coupon to. The December 2020 total local sales tax rate was also 7525.

Duluth Minnesota Mn Profile Population Maps Real Estate Averages Homes Statistics Relocation Travel Jobs Hospitals Schools Crime Moving Houses News Sex Offenders

Employment Opportunities Sorted By Job Title Ascending City Of Duluth Career Pages

St Louis County Land Sale Facebook

Saint Louis County Mn Land For Sale 661 Listings Landwatch

Crow Wing County Mn 2021 Delinquent Tax List By Brainerd Dispatch And Echo Journal Issuu

1 1 Acres Of Residential Land For Sale In Duluth Minnesota Landsearch

St Louis County Missouri St Louis County Website

Duluth Minnesota Mn Profile Population Maps Real Estate Averages Homes Statistics Relocation Travel Jobs Hospitals Schools Crime Moving Houses News Sex Offenders

7 7 Acres Of Residential Land For Sale In Duluth Minnesota Landsearch

Board Of Commissioners Members

Tax Forfeited Land Sale Includes 18 Houses Former Clover Valley School Site

Best Places To Live In Saint Louis County Minnesota

St Louis County Minnesota Departments A Z Public Health Human Services Public Health Covid 19 Learn More About Covid 19